Is the Real Estate Market in Bubble Trouble?

By Kendra Todd – September 26, 2006

You can’t go anywhere without hearing people talk about “the real estate bubble.” Such talk drives me to distraction, and I’ll tell you why. It’s because there is no real estate bubble. Bubbles are for bathtubs.

Despite a thousand articles in Sunday newspaper real estate sections, the bubble is a myth. The real estate markets in many areas are going through a normal correction cycle. I’m going to tell you how to recognize the signs of a correction in your market, how you can avoid getting sucked into “bubble trouble,” and how you can even benefit from the current environment.

Pop Goes the Market?

A bubble is a market in which the value of the key asset is inflated based on speculation and psychology. Because of this, true bubble markets can burst overnight when something happens to shatter the perception of value. That’s why the Internet boom of the late 1990s was a true bubble; people suddenly realized that ninety percent of the dotcoms were companies with no way to make money. Talking about a bubble implies a sudden burst, and real estate does not work that way. You don’t go to sleep one night with your house worth half a million dollars and wake up to find it’s lost half its value. Also, the real estate market is a regional phenomenon based on all kinds of factors: migration to or from an area, job growth, and local economies. So while there is no bubble, there are areas in the U.S. that are experiencing corrections that will continue over the next six to 24 months. There are also markets that will appreciate over that same period. The trick is keeping your cool and taking advantage of the opportunities.

A Bubble is a Matter of Perception

Take the Southern California real estate market. It’s reached a median price of well over half a million dollars after three years of 30, 40, and 50 percent appreciation. That’s unsustainable. There are not enough people with the income to keep buying homes in that market now that the Federal Reserve has raised interest rates. Before, buyers could slip into a $500,000 home with a 5.25% mortgage, but the cost of money has gone up, so those people can’t buy.

The result? The L.A. metro market is coming back to a more realistic level where homes appreciate more slowly and sell for less. This is where perception comes in. If you haven’t gotten the memo that the market is changing, this will appear like a reason for panic. If you’re still thinking you can buy a house, hold it for a year, and “flip” it for a 30% profit, you’re in for a reality check. But if you can spot the signs in your area that the market is slowing, you can stay calm and even profit.

Signs of a correcting market:

- More inventory on the market.

- Houses stay on the market longer.

- Sellers are forced to drop their prices, often multiple times.

Real estate is cyclical, and the cycles last for years. It’s a mistake to react based on what has happened in the last six months. Speculation throws everything out of whack because it’s a short-term strategy. Real estate investing must be for the long term.

The Hot Markets

Because real estate is regional, there are many “secondary markets” that remain promising. These are usually smaller cities with attractive lifestyles or “feeder” cities that serve larger, overpriced metro areas:

- Tucson, AZ

- Orlando, FL

- Wilmington, NC

- Asheville, NC

- Santa Fe, NM

- Boise, ID

These areas are still affordable, which makes them very attractive. They have healthy economies and are good opportunities to get into now. That’s the question you should ask as an investor: “What markets should I be getting out of, and what markets should I be getting into?” Even when the hottest markets are in correction mode, there are always high-value markets for the smart investor, as long as you look at price point and the potential for appreciation.

Stay Cool for the Long Haul

The most important thing you can do in this real estate environment is avoid panic selling. Real estate is not like the stock market. It’s like a drive through the Rocky Mountains. You will have rises and dips. Hold tight and wait it out, especially if you live in a market that has strong fundamentals, like lots of people still moving to the area. Over the long term, the value in real estate will stabilize, and you’ll profit. Now is not the time to sell. But it is a great time to buy.

READ MORE ARTICLES

FROM OUR BLOG

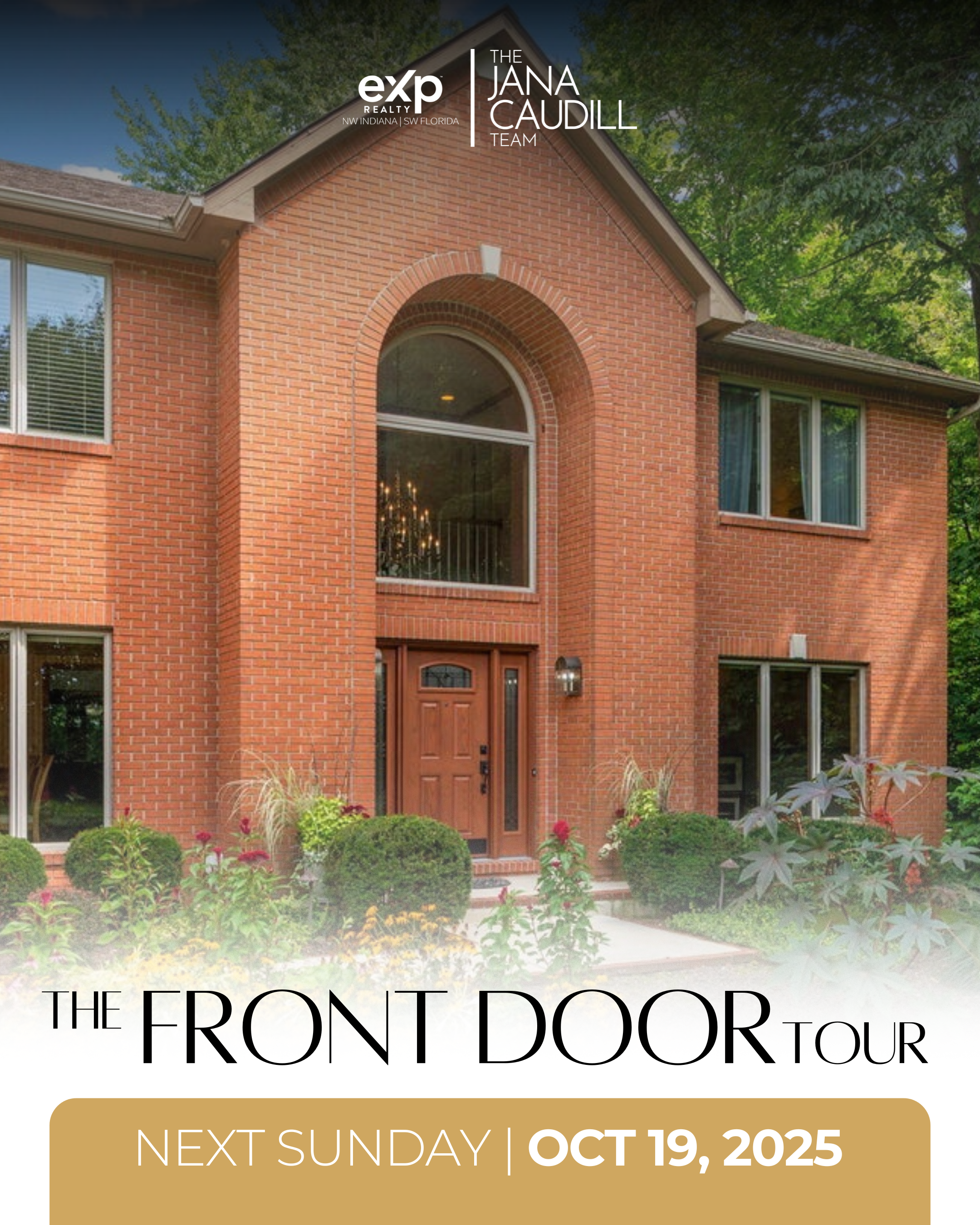

What Buyers Should Know About Negotiating the Sale Price of a Home

Negotiating the price of a home is one of the most critical…

How to Sell Your Home During the Off-Season

Selling your home during the fall and winter months can seem like…

Why Buying a Lake House is a Great Investment

Picture yourself sipping morning coffee while watching the sunrise reflect off pristine…

the jana caudill team

has sold more real estate in

nwi than any other realtor!

work with us

The Jana Caudill Team delivers unparalleled service to all of our clients with honest representation, communication, attention to detail, and results. Reaching your goals is our number one priority.